The technology innovations of the digital era are driving sweeping IT and telecom network architecture changes that are generating global opportunities for equipment installers.

Through 2019 and beyond, telecom and IT industry leaders are expected to push forward on the next phases of the worldwide preparations they’ve been making for 5G and the Internet of Things (IoT). Some major Asian countries are also planning or implementing projects that will extend connectivity to underserved populations.

While the past few years have been full of prep work, international IT and telecom companies will likely be seeing it pay off in 2019 and the next several years through 2023. Further, in the IT industry, the growing mass move to cloud services has changed the industry landscape. Changes like these present opportunities to the IT equipment installation vendors who are implementing new programs and services.

Where are the Major Areas of On-Premises Equipment Growth?

This year, both IT and telecommunications technology equipment installations are expected to continue growing globally. In telecom:

-

Asia Pacific (APAC) — Cabling contractors and equipment installers in the APAC region are busy preparing for the worldwide rollout of 5G. In India, work is continuing on their national connectivity and "smart cities" initiatives.

-

U.S. — North America is also undergoing sweeping growth of 5G infrastructure projects. The U.S. is second only to India in terms of work to position for the advent of 5G, which could likely open the way for the IoT revolution.

2019 IT Outlook for Capital Equipment Installers

According to the Equipment Leasing & Finance Foundation (ELFF)’s 2019 U.S. Economic Outlook, investment in equipment and software will increase by 4.1% in 2019. Credit market conditions are strong; however, demand for credit is weakening, indicating that a downturn might be coming in the latter half of the year. ELFF’s chairman and managing director reportedly indicated that the equipment finance industry’s lending conditions are favorable and are likely to grow at the beginning of 2019.

ELFF isn’t the only organization predicting positive growth for the technology industry. Forrester also suggests that technology equipment and services will grow by 5% this year. This growth will likely occur in the technology market because the overall economy is strong and growing in countries like China, India, and the United States. Economic and tech growth are not limited to these countries, however, and growth is expected for European and Latin American countries, as well as Canada and Australia.

How is this Growth Happening?

First of all, businesses are buying new technology more often than they have in the past. Because the economy is doing well, they have the freedom to expand their tech instead of painstakingly monitoring their expenses. Businesses need to grow revenue, and investing in technology is a smart way to do so. But what are businesses investing in this year?

Cloud-based services are incredibly popular, and it shows as they are growing by a rate of 20%. This spike comes because critical technology like CRM and e-commerce is switching over to cloud services. As cloud platforms continue to expand around the world, this growth is not likely to decline anytime soon. Hardware investment, on the other hand, is decreasing and will continue to do so as more businesses, people, and services are moving to the cloud.

2019 Telecom Outlook for Capital Equipment Installers

A recent S&P Global Ratings study has predicted global telecom revenues to grow by 2%-3% this year. Just as cloud-based services are growing, so is the need for high-speed data. It’s obvious that the use of cell phones, tablets, laptops, and the array of other devices that connect wirelessly has grown. The digital revolution has expanded far beyond streaming video and browsing the internet. With the advent and expansion of smart homes, our lights can follow voice commands, and ovens can preheat themselves. This creates a major load on broadband and the internet, pushing governments and global corporations to provide stronger and faster connections.

Chairman Ken Hu, of Chinese tech giant Huawei, said that “5G will start a technology revolution [that will] trigger sweeping changes in business.” As always with the implementation of major new technology, the rollout of 5G will come at various times across the markets, depending on government regulation, infrastructure, and other resources.

Overall IT and Telecom Equipment Installers 2019 Outlook

Telecom and IT equipment and cabling installation companies are facing a great opportunity. Many major Asian regions are expanding their systems and making significant upgrades under government initiatives. This has created an installation boom for the IT and telecom industries. At Kinettix, our global network of IT support partners already serves markets in over 90 countries, but we are looking to expand our network of IT support vendors.

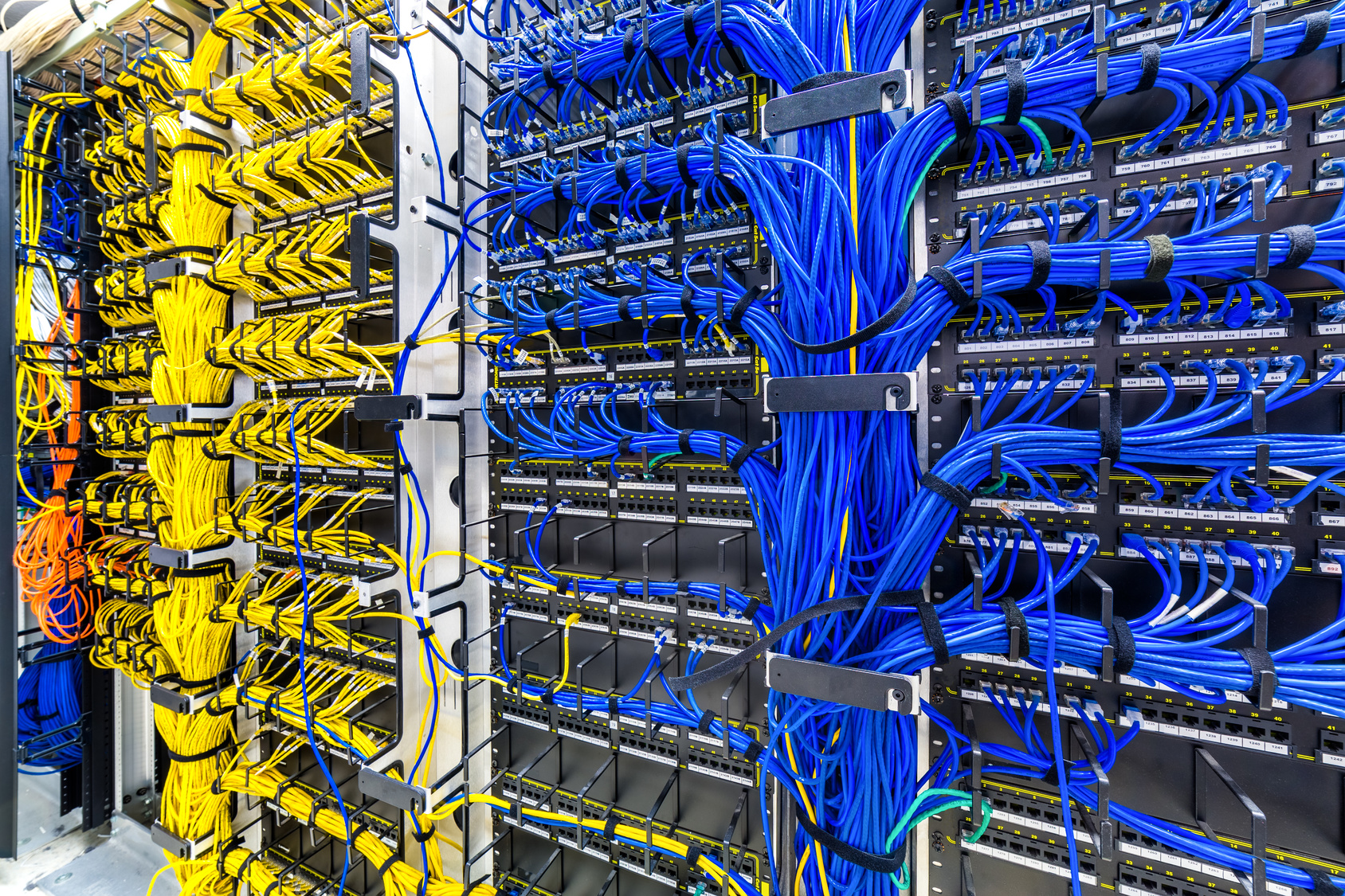

This expansion is driving upgrades for previously underserved consumer populations. IT connectivity and service, broadband internet, and mobile streaming use a significant amount of data in telecom systems. Because of this, IT service providers will find business opportunities in upgrading and servicing routers and switches to handle increased data use.

The most active markets for IT support vendors with strong equipment installation expertise in 2017 and 2018 were China, the Asia Pacific region, and North America. Going forward, strong growth in opportunities for talented equipment installers in these areas is predicted to continue through 2023. Kinettix is looking to expand our network of IT support vendors, including customer premises equipment installers.

About Kinettix

We supply IT field services to U.S.-based companies that are expanding their operations internationally. Kinettix's global network of IT support partners serves markets in over 90 countries, providing a broad field of opportunities for highly effective IT and telecommunications equipment installers. Visit our Global Alliance page for details about how Kinettix selects vendors.